For 30 years, Shields Brokerage has been committed to providing products, marketing and sales support to producers in the LTC marketplace, and it’s paying off! We are receiving calls from our producers who have seen the value of a LTC policy in action for their clients. The client is being cared for and the families are grateful that an LTC plan was in place and it’s working! Unfortunately, we have also witnessed families struggling when a loved one’s health has worsened, and they had failed to plan for a long term care event.

For 30 years, Shields Brokerage has been committed to providing products, marketing and sales support to producers in the LTC marketplace, and it’s paying off! We are receiving calls from our producers who have seen the value of a LTC policy in action for their clients. The client is being cared for and the families are grateful that an LTC plan was in place and it’s working! Unfortunately, we have also witnessed families struggling when a loved one’s health has worsened, and they had failed to plan for a long term care event.

Here’s a conversation you should have with your clients this month.

“When should you buy? It’s true that most long-term care insurance claims are made when people reach their golden years, but there’s a misconception that you should wait until you’re approaching retirement to buy a policy. Waiting too long to purchase a policy can be very costly. Because rates are based on age and health, it’s best to start shopping for a policy when you’re young and healthy. A good time to purchase is when you’re in your 40s or 50s. You can certainly buy a policy when you’re in your 60s or even older, but expect to pay considerably more. Plus, if you wait too long and develop a condition that may require long-term care, you could become uninsurable.”

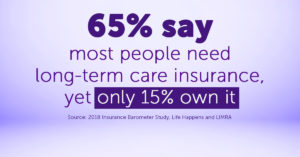

That is why we at Shields Brokerage believe it is critical to have a long term care plan. Long Term Care Awareness Month is the perfect time to have this important planning conversation with your clients, and we can help! Stacy Shill, CLTC has an offer for you to just start process . Have Stacy be part of the LTC conversation with you and your client, it’s that simple! Producers see great success when Stacy is part of the conversation and presentation to your clients. By being part of the process all the way, you soon will be writing more LTC cases on your own.

Contact Stacy for a great consumer piece to start the LTC conversation, and to schedule a call with a LTC prospect We also have resources like consumer education videos, Cost of Care interactive maps and more information through our carriers Genworth, Mutual of Omaha, National Guardian Life, One America and Lincoln Financial.

Let’s help your client make a LTC Plan today!

Contact Stacy Shill, CLTC

sshill@shieldsbrokerage.com

603-418-0812